Where can Interpath help?

We have a global multi-disciplinary team with broad experience and skills to assist in the crypto and digital asset sector. The team and services below mean we can provide advice and solutions for corporates, investors, and regulators. Working together with corporates and/or their key stakeholders, we can help you to identify the best course of action and drive the process to a resolution.

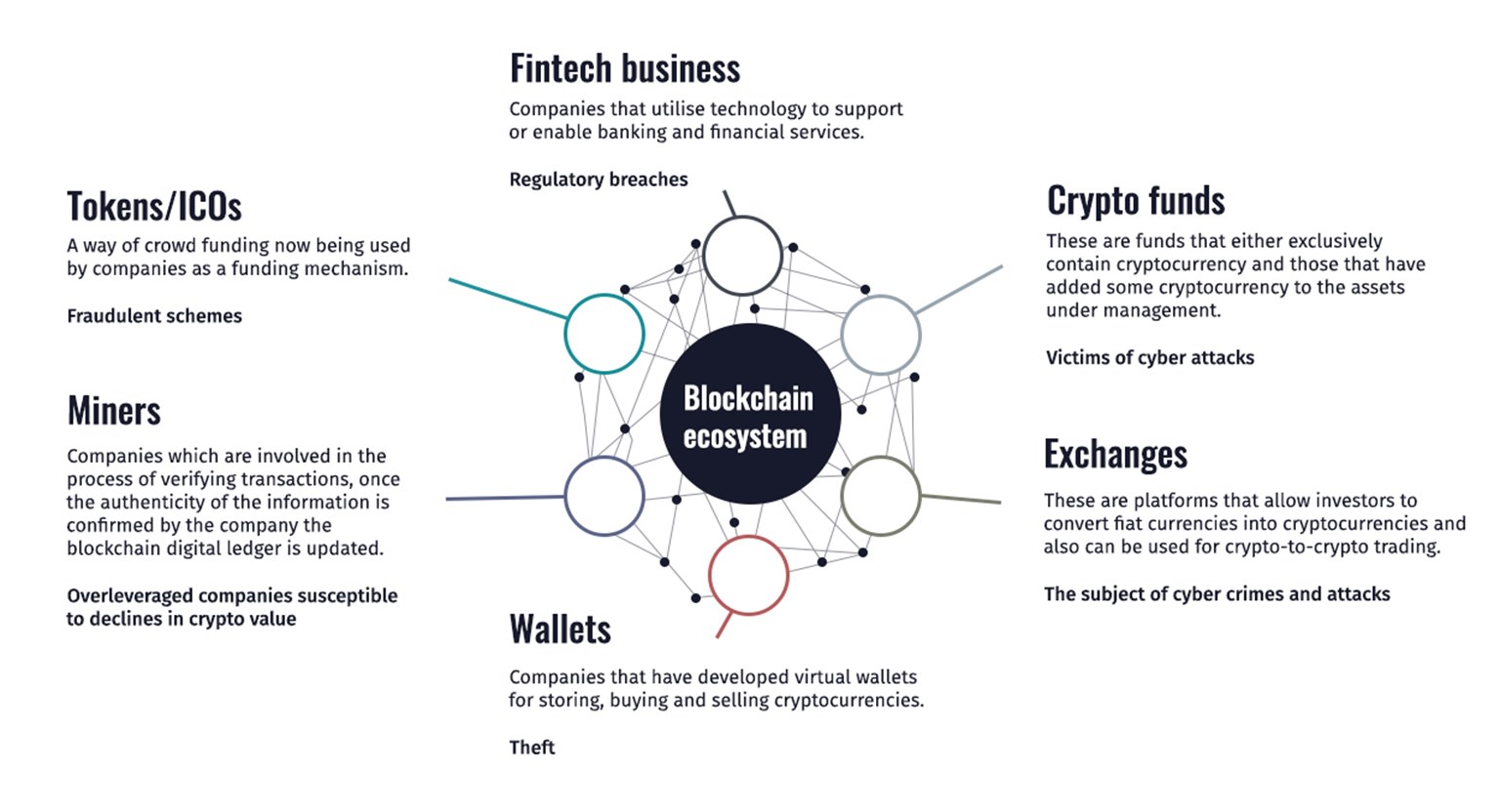

Interpath is well equipped to support participants of the blockchain ecosystem.

Anti-money laundering, governance and conduct

Interpath offers solutions designed to help your firm meet the high standards of conduct and compliance expected by customers and regulators. We can help you develop robust systems and controls, particularly around know your customer (KYC), anti-money laundering (AML), governance and conduct.

We can support you with applications, regulatory requests and litigation, and provide outsourced compliance services, compliance advisory support (from risk assessments, though to training and policy reviews) and regulator-mandated audit services.

We have worked for regulators and understand their expectations. We are best placed to assist you in interpreting rules and implement controls that fit your business and its size and complexity.

Forensic investigations into fraud, thefts and hacks

We are a market leading specialist in asset tracing and investigations. We analyse large amounts of complex data and monetary transactions to enable clients to make sound decisions and trace financial flows through to their current destination to identify and determine strategies to recover misappropriated or embezzled funds. We offer insights to prevent fraud, supporting management in mitigating reputational and financial risk as well as identifying remediation.

Interpath recently assisted in the ground-breaking matter of ChainSwap Limited v Persons Unknown, where unidentified crypto hacker(s) made off with millions of US$ stablecoins. We were able to successfully trace the proceeds of the hack whereby the smart contract of a cross-chain bridge was compromised. Our expert investigative report and findings were used by the client and its legal counsel in the applications to the BVI Court seeking disclosure from the exchange and granting freezing orders. Our on-chain investigative and tracing work performed in support of these proceedings were crucial to enabling this application and decision and the further steps thereon to making a successful recovery for the client.

Restructuring and Advisory

We are happy to discuss options available to entities in, or anticipating, distress; whether that be mechanisms to deploy a formal, organised process allowing appropriate breathing space; managing stakeholders; or considering restructuring. These important conversations and discussions may be an opportunity for us to help clients and its director(s) in navigating challenging times before the need for formal orderly wind downs are necessary or the decision is taken out of their control.

Directors have fiduciary duties which they need to consider at all times and our experience has shown us that being proactive with these decisions will provide greater comfort and protection to them and all stakeholders. For instance, being able to discuss restructuring to determine whether that is the right course of action and then, if necessary, choosing your own advisors as part of an organised strategy is often preferable rather than a disorganised and litigious situation being imposed on you by a creditor or state/government where the best interests of the collective group might not be paramount.

Insolvency

When a company is insolvent, key stakeholders seek our appointment as administrator, liquidator or receiver. We work to maximise the realization of assets, and distribute these assets to investors and creditors.

Interpath has liquidated funds and entities invested in digital assets and can assist with managing risks arising from the exposure to highly volatile assets classes in a way that is in the best interests of creditors and other stakeholders.